Our industry adopts many practices from the European woodworking industries. Equipment, processes, hardware and other material were introduced in Europe first and then eventually adopted in the industry in North America. One practice, in my view, has not gotten the traction in the wood industry.

In Europe, companies outsource to a much larger degree than here in Canada or the U.S. To be clear, I am referring here to the outsourcing of production and services domestically, not to outsourcing to low-cost countries overseas. That is a subject for another time.

What do other industries do?

As we are not the technological leader in manufacturing, we can have a peak into other industries and take notes. Automotive comes to mind. Almost universally, all companies outsource 80% (give or take) of the manufacturing to suppliers, often focusing only on the assembly of the car.

However, when Henry Ford in the 1920’s built his plants, he wanted to be independent of suppliers. Ford drove the concept of vertical integration and forged his own steel; harvested rubber in Brazil to produce car tires and even produced his own glass.

Since then, all carmakers have gone through several evolutions and different definition on what they believe their core competency should be. The result is that companies design, assemble, market, and sell their product. Pretty much everything else is up for discussion.

What doe this mean for us?

To begin with, everyone does some outsourcing; nobody is 100% vertically integrated and makes furniture from the trees they planted. Even giants like IKEA do not have their own particleboard plant, even though their combined purchases fill the capacity of many plants. Larger companies have huge hardware requirements, which - on first glance - could keep your own, in-house manufacturing of hardware busy and profitable. They have the brainpower to think this through and the fact that very few are doing it means to me that volume alone is not the overriding factor.

Why don't companies outsource more?

For this discussion today I will use the example of a typical kitchen cabinet plant thinking about outsourcing doors and dovetail drawer boxes. These examples can be translated to other manufacturers and other outsourced items.

Suppliers are not reliable in lead-time, quality, capacity, and flexibility

Well, if this is a fact, then the companies should not outsource to such suppliers. The relationship with your suppliers must be a working partnership. The relationship must be more than sending orders. Many details need to be worked out and the suppliers need to be included in the set-up of the supply chain, the same way you would include the key people in your factory making these parts in-house.The supplier relationship needs to have long-term objectives and needs to continuously improve.

To highlight the need for reliability, just think about how serious an event of a late shipment is in an automotive plant. Besides the crippling monetary fines, repeat offenders will lose their business.

We can produce the product at a lower price!

On this point, I like to argue on both sides, because it always “depends.”

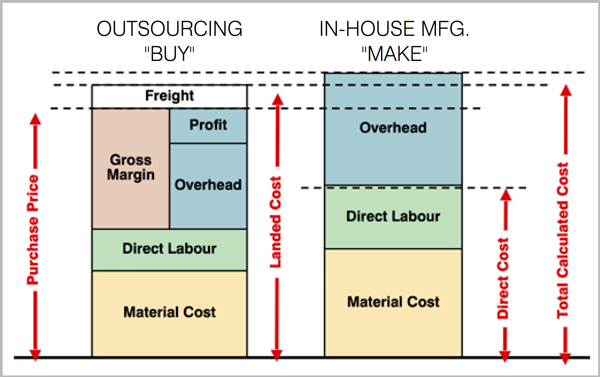

Chart 1 depicts comparison using typical cost calculation.

Case 1:

You currently produce the product in-house and are thinking about outsourcing

If there are no other driving factors available, the calculation usually does not suggest outsourcing.

Even if the calculated total (in-house production) cost might be higher than the purchased landed cost, it is not a clear decision. If you outsource, you are not saving the overhead. The building, the machines and the other overhead elements are still on the books, so the savings are only the material and direct labour cost.

In this case the supplier competes against somebody who charges only material and direct labour, and on that basis it is unlikely that the supplier can meet the price point. If the supplier buys material (volume) at a better price, the better technology (better yield, lower labour cost) and has extra capacity (discounted price) then it might work.

Case 2:

Your current in-house production is the bottleneck, and you could ship more if you outsourced

In this case, the gross margin of the additional product shipped will all go to the bottom line (or the reverse, the missing gross margin of the not-shipped volume is missing from your bottom line).

In such a scenario a higher purchase price (compared to in-house costing) would be justified.

I see this case often in nesting-based manufacturing models. The nesting machine has a bit of extra capacity after producing the case parts, but becomes the bottleneck when starting to make one-piece shaker MDF doors. This move then slows down the overall output.

Sometimes the company has hidden or false bottlenecks. For example, the factory has all the machine capacity it needs, but does not have enough staff to process the doors, drawer boxes, etc. in-house. When calculating the in-house manufacturing cost the traditional way, based on the individual operations, this usually supports a clear ”make” decision. However when

reviewing the impact on the operation as a whole, the decision could swing to “buy.” Such problems can be permanent, seasonal or mid-term. Again, a partnership with a competent vendor can solve that problem.

Case 3:

You currently do not produce these parts in-house (i.e. new parts) and you are considering setting up for in-house production

To start with, there are a few questions you should ask yourself:

Do you have the space?

Do you have the equipment, or how much do you spend on suitable equipment?

Do you have the people, including management, to master the additional complexity?

Do you have the expertise?

What is the projected volume, is this ongoing requirement or just a short-term solution?

A common challenge is, for example, the solid wood dovetailed drawer boxes. If you use your actual numbers to get the answers, your facts will guide you and the decision is much easier.

It does not mean that the situation is static and you cannot change direction later. When your volume is low or very irregular, maybe outsourcing is the solution. But as the volume increases enough to a steady demand, a production cell might be justified.

Fashion trends and seasonality might be another driver for outsourcing. We’ve all experienced the drastic shift from solid wood 5-piece doors to the white painted MDF shaker doors. Additionally, we see an increase in the polyester-wrapped 5-piece mitre doors, and the laminate high-gloss doors taking market share. You only want to invest in equipment if you can foresee enough of a payback.

The trend to more variety in laminate doors will require more edgebanding capacity. Not only more capacity, but also a much higher edgebanding quality. Companies need to decide if the existing edgebanders, which are good for case parts are sufficient in the future, or if new edgebanders with superior edgebanding glue line (laser, zero-edge, etc.), pre-milling and trimming are required.

Is there a case for not outsourcing”?

Automotive industry suppliers set up manufacturing facilities around their customers. So, distance and the related freight cost, lead and reaction time are a factor. A great example of outsourcing in proximity is the chair manufacturing concentration in Udine, Italy. Hundreds of companies there are producing chairs, but most of them are concentrating on specific operations. For example, making components, assembly frames, finishing upholstery, etc.

If distance were the deciding factor, we would not see door manufacturers from Quebec sell doors in British Columbia and Alberta. We would also see much more outsourcing in the Greater Toronto and Hamilton Area with a high concentration of competent woodworking companies.

One critical factor is core competency. If there is something one company is specifically good at and this really separates them from their competitors, they should not outsource that. When looking around, it is difficult to point at something so unique that it needs to be protected.

We can reiterate all factors and when you look at your specific situation, we can end up on either side of the make or buy decision. It all depends on your specific situation and the available options.

The key factor is and remains that there must be competent suppliers with a passion for service and performance. This goes hand-in-hand with manufacturers reviewing their own value chain with an open mind.

Simplify

We would be really surprised if Toyota would equip its cars with Toyota tires, or Mercedes would develop its own audio system instead of installing Bose® equipment. They would have the deep pockets needed to develop their own solutions, but one important reason why they don’t is that they want to reduce complexity.

Understand what your core competency is, get better and better at it. If it is not core competency, and not the best in class (or close to it) check out if partnering with a supplier would make you overall better. In our example of the kitchen cabinet company, is their kitchen of lesser value to their customers/consumers because they did not make their drawer boxes from scratch?